extended child tax credit 2022

No Tax Knowledge Needed. 2022 Expanded Child Tax Credit.

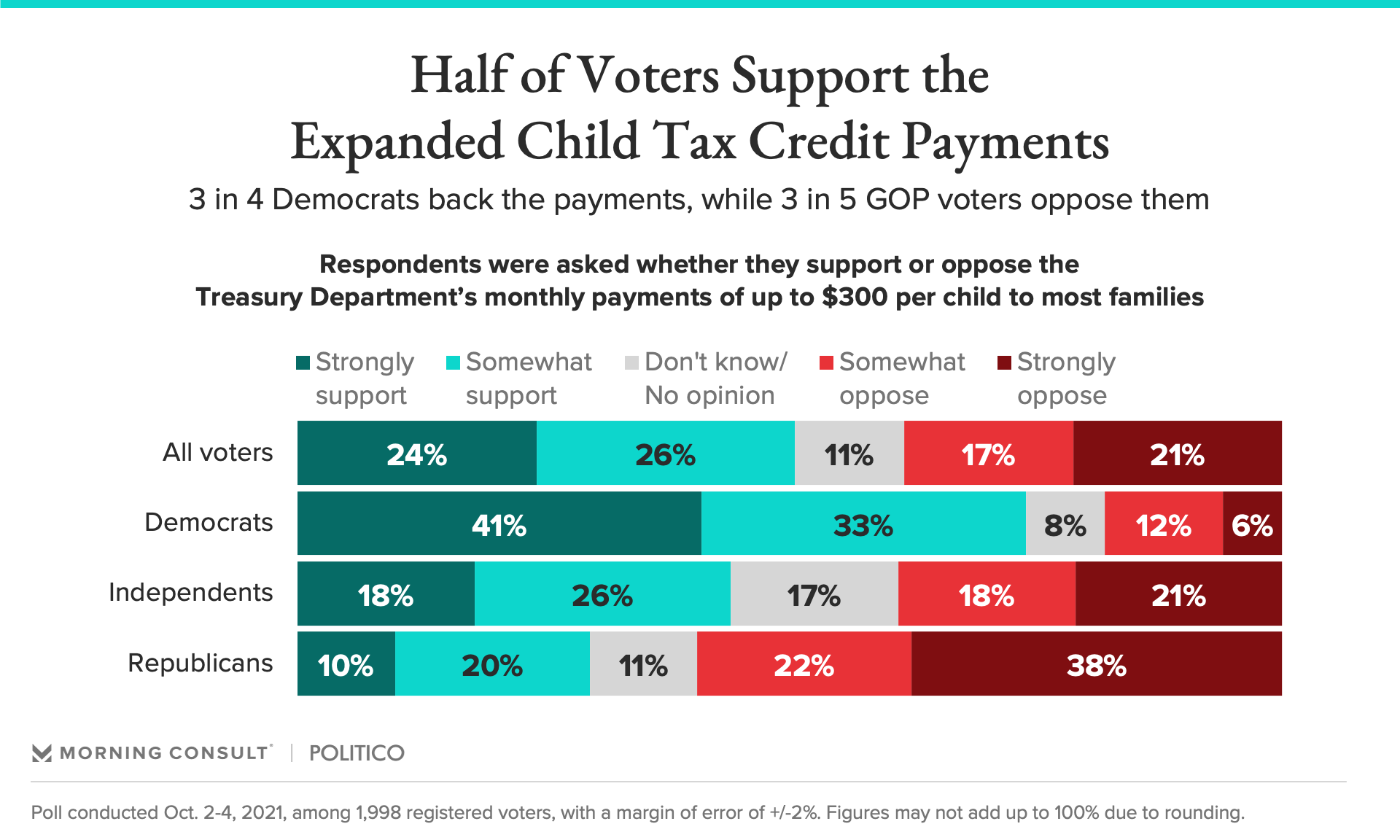

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

. File With Confidence Today. For 2022 the tax credit returns to its. David Brancaccio Chris Farrell and Jarrett Dang Mar 24 2022.

According to the tax policy center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more. The good news is. Ad Free tax support and direct deposit.

In fact he wants to try to make those payments last for years to come all the way through 2025. President Biden wants to continue the child tax credit payments in 2022. The boosted Child Tax Credit did so much good that lawmakers initially sought to make it permanent.

Under the proposed legislation the 2021 version of the child tax credit would be extended for an additional year but with some important changes. Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. There is no limit on the number of children who are eligible for the expanded child tax credit but your income level will affect the amount of credit you receive.

The advance is 50 of your child tax credit with the rest claimed on next years return. To do so you must first get IRS Letter. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Singles must have a. Answer Simple Questions About Your Life And We Do The Rest. But Things Will Change Again When You File Your 2022 Return As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the.

However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have. File With Confidence Today. Some of the proposed.

The child tax credit isnt going away. Tax season 2022 officially began on Monday January 24 allowing individuals to receive extra money from the extended child tax credit. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

President Biden then settled on a one-year extension for 2022 and wrote. The expanded Child Tax Credit by comparison provides 3600 for each child under six and 3000 for children between 6 to 17. Tax refunds could bring another 1800 per kid.

How much is the 2021 child tax credit continued. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Ad File 1040ez Free today for a faster refund. Taxpayers are eligible for the maximum credit if they have a modified adjusted gross income AGI of. While the expansion of the child tax creditagain in 2022 remains uncertain the money from the 2021 credit hasnt been fully dispersed yet not by a long shot.

No Tax Knowledge Needed. Answer Simple Questions About Your Life And We Do The Rest. The expanded child tax credit did not have a negative short-term employment effect that offset its.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Solar Tax Credit Extended For Two Years In 2021 Residential Solar Solar Tax Credits

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Ldrp Stat 2 2 21 In 2022 Organ Donation Medical Leave Organ Donor

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Child Tax Credit Checks Are Here How Are Parents Spending Them The Lily In 2022 Child Tax Credit Tax Credits Form Of Government

Here S Who Qualifies For The New 3 000 Child Tax Credit

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities