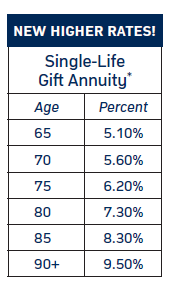

charitable gift annuity rates

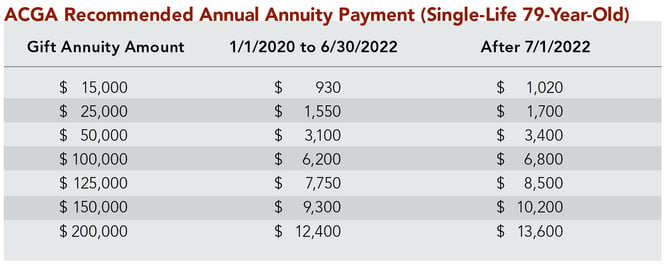

Under the current rate schedule Mary 79 transfers 25000 in exchange for a charitable gift annuity. The University of Minnesota Foundation will offer these higher rates for new gift.

How You Can Give Gift Annuity University Of Cincinnati Foundation

Sample Annuity Rates for Gift Amount of 25000.

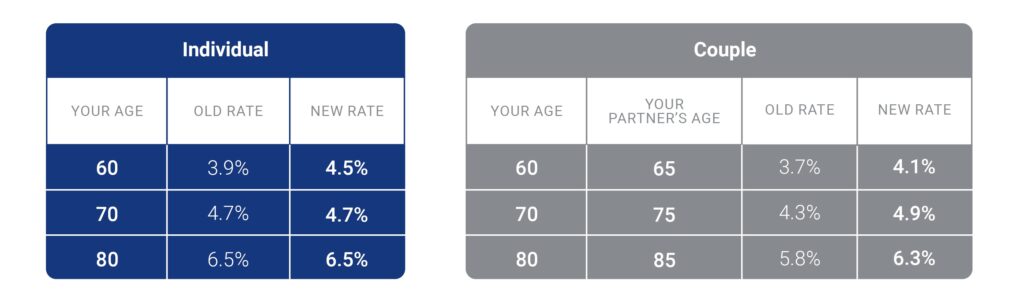

. Age Annuity rate Annual payment received Charitable deduction. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. Sample Annuity Rates for Gift Amount of 100000.

The ACGA suggested rate schedule is designed to. Rates for two lives also available. With the new rates.

You will earn an immediate income tax charitable deduction in the year of your gift providing tax savings if. As with any other. As of July 1 2022 Duke can offer even better annuity rates than before.

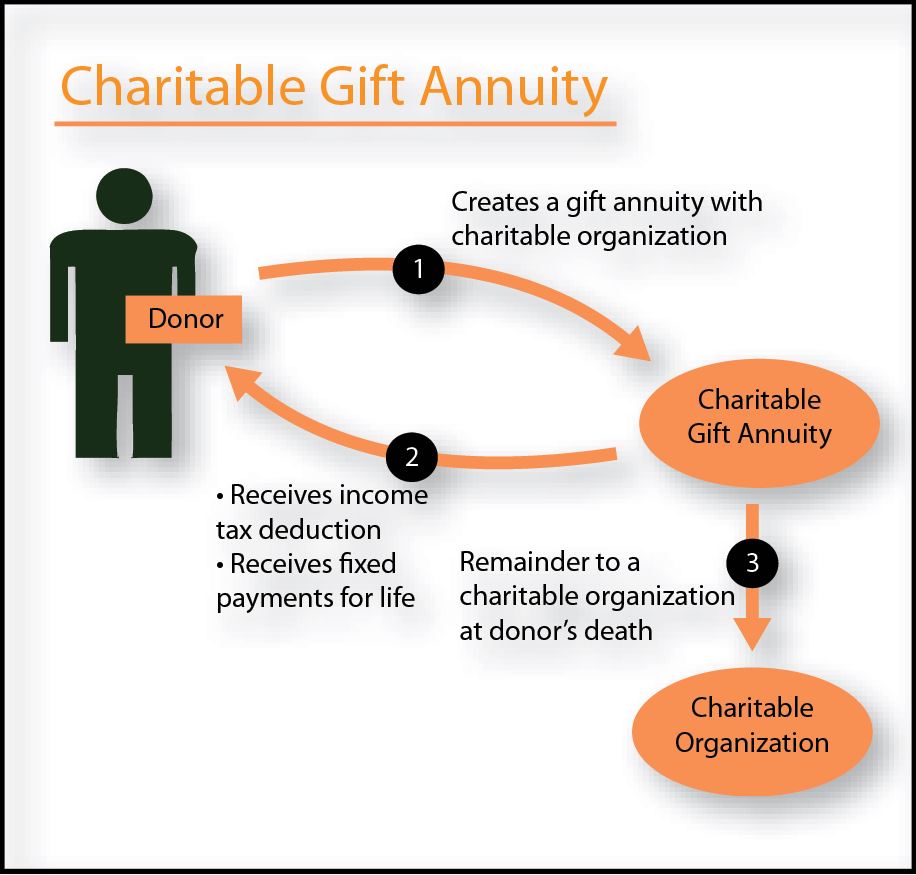

A charitable gift annuity is a gift in exchange. The charitable gift annuity rates suggested by the American Council on Gift Annuities have increased. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout.

The minimum amount necessary to create a gift annuity at Harvard is 25000. The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting. And once you lock in your higher rate it is yours for life no matter how the markets change in the future.

Barbara would have received annual payments of 1350 based on a payout rate of 54 percent. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. 133 rows Rates Announcement - 6222.

Rates are for single-life income beneficiaries. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Gift annuities can be funded by a variety of assets.

Barbara 72 transfers 25000 to Northwestern in exchange for a charitable gift annuity. Two Lives Joint Survivor Younger Age Older Age Rate. How is a Gift Annuity Created.

Charitable Gift Annuity. Age Payment Rate Annuity Deduction. The payment rate for joint gift annuities is.

Age Payment Rate Annuity Deduction. Charitable gift annuity rates for one person ages 81 and up. If the sole annuitant will be nearest age 65 on the annuity starting date and the compound interest factor is 21082 the deferred gift annuity rate would be 21082 x 60.

For many charitable organizations the minimum required gift for an annuity is 10000 or more. Establish minimum gift sizes and rate schedules. A charitable gift annuity.

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. With the old rates. She will receive annual payments of 1550 a rate of 62.

Barbara receives annual payments of 1450 based on the new payout rate of 58 percent. You will incur no costs to establish the arrangement and no costs to maintain it.

Everything You Need To Know About A Charitable Gift Annuity Due

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

Your Guaranteed Paycheck For Life University Relations Creighton University

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Charitable Gift Annuities Preachers Aid Society And Benefit Fund

Spencer Sacred Heart Charitable Gift Annuities Spencer Ia

Fy13 Charitable Gift Alzheimer S Association

Ku Endowment Charitable Gift Annuities Charitable Gift Annuities

Planned Giving Gifts That Pay You Income

Giving To Tulane New Charitable Gift Annuity Rates

Special Update New Cga Rates Released

Charitable Gift Annuity Rates Scheduled To Change Washington State University

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Act Now Charitable Gift Annuity Rates Have Increased Giving To Duke

Create Lifetime Income With A Charitable Gift Annuity Orlando Health Foundation